FTX Exchange: trading guide, registration, verification and job reviews!

Exchange Token

FTTLanguage

RussianVerification

RequiredApplications

IOS/Android/WebTrading Options

Spot|Margin |Futures|Stocks|Leveraged Tokens|NFTScam! The exchange is insolvent.

The founder of the exchange is under investigation for providing clients' money to an affiliated company, Alameda Research, in the form of interest-free and perpetual loans without collateral. As a result of his actions and unprofitable trades from Alameda Research's side, the FTX exchange failed to cover clients' fund withdrawals, and its assets are insufficient to repay all liabilities. The closure of the FTX exchange is one of the largest scams in cryptocurrency history. We will continue to monitor the situation. The review remains for historical purposes.

FTX is a cryptocurrency exchange focused on trading with a wide range of products, including derivatives, options, volatility products, and leveraged tokens. On the official website 👉 FTX.com, users have the opportunity to trade 130+ different cryptocurrencies.

Getting Started with FTX Exchange

FTX Exchange started operating in 2019 and despite its apparent youth, it has gained significant trust among various layers of crypto enthusiasts. The reason for this is that FTX has its roots in two major systemically important projects: Binance and Alameda Research.

The largest centralized exchange, Binance, is the main investor in FTX, which already speaks to the seriousness and reliability of FTX. The icing on the cake is the personalities behind the exchange: Sam Bankman-Fried and Gary Wang, who founded the legendary Alameda Research. All projects that Alameda invests in in the future "take off" by hundreds of times.

Account Registration

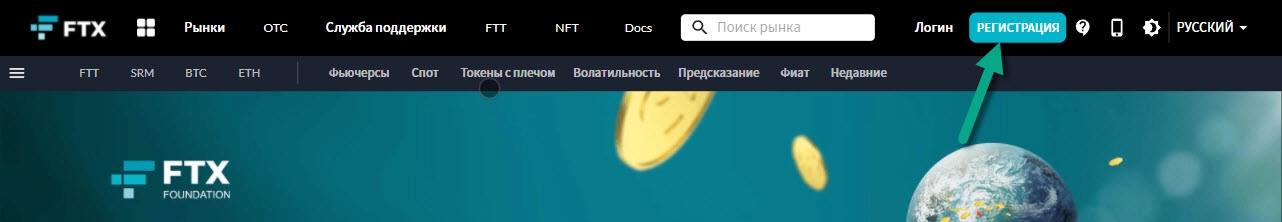

To start the registration process on FTX, go to the official website 👉 FTX.com and click on "Sign Up" in the top right corner.

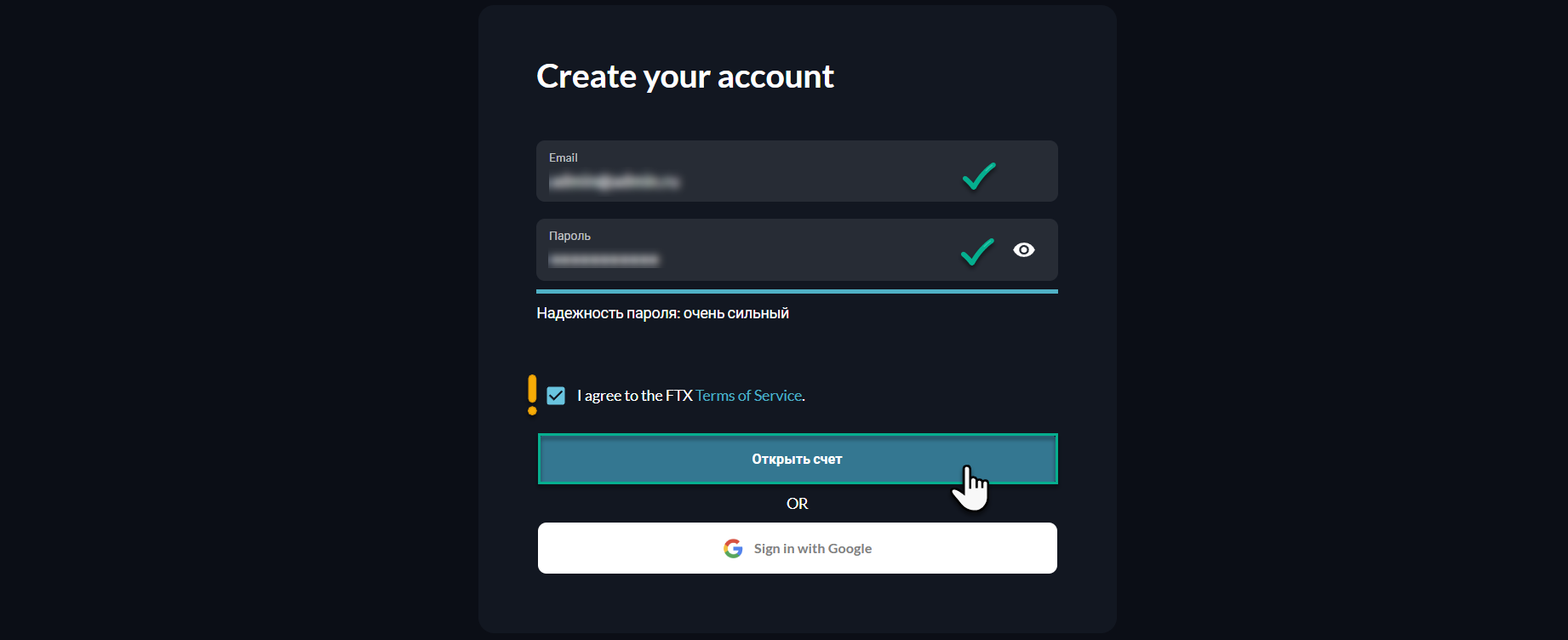

Next:

- enter your email address;

- choose a password (remember to save it in a secure place!);

- agree to the terms of service.

That concludes the registration on the exchange.

Verification on the Exchange

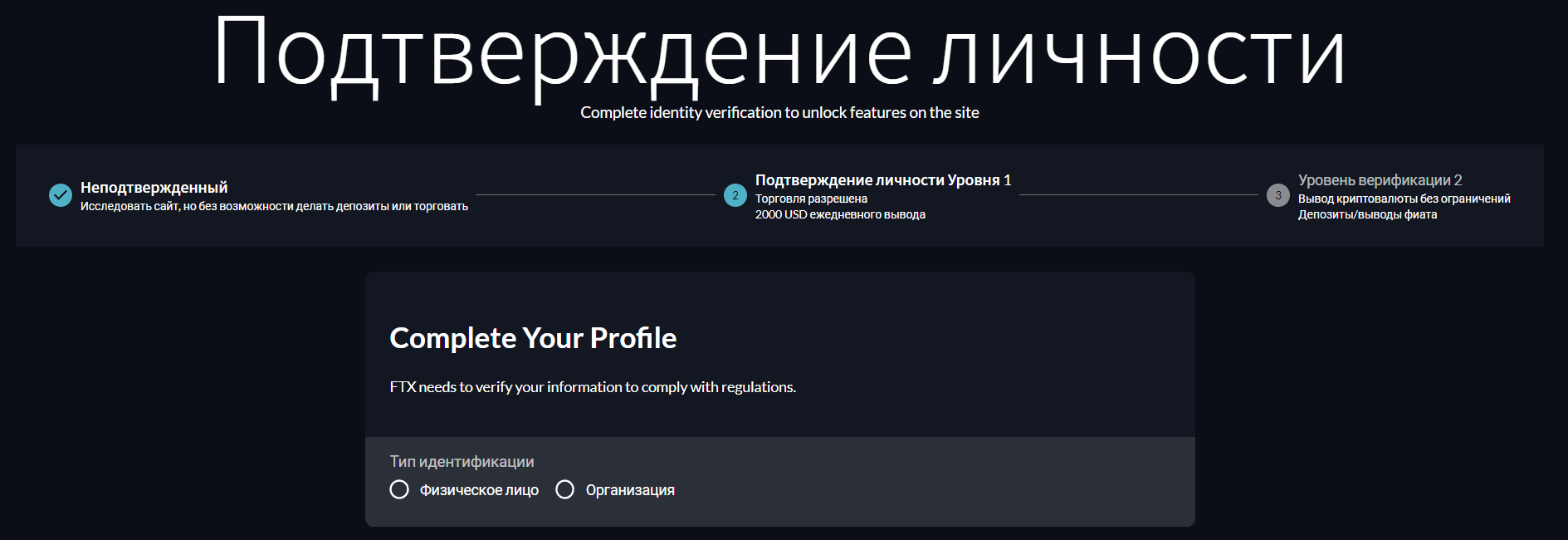

Immediately after registration, you won't be able to perform trading operations since each FTX account is assigned a certain level that determines the trading capabilities and the volume of funds for daily deposits and withdrawals. In fact, users are not allowed to use FTX's functionalities without mandatory verification.

Mandatory verification is normal and permissible for centralized exchanges due to regulatory requirements. An unverified user can still access limited functionality such as viewing quotes, charts, etc., without making trades.

Let's consider each of the account levels and how to obtain them:

Level 0.

Automatically assigned to all new users. Level 0 does not allow deposits or withdrawals on FTX, nor access to trading functions.

Level 1.

To reach this level, you need to undergo a Know Your Customer (KYC) procedure. As part of the FTX verification process, you need to provide your personal information: surname, first name, residential address, and confirm this information with a scanned copy of your passport or driver's license. Level 1 users can withdraw up to $2,000 worth of cryptocurrency from FTX daily.

Level 2.

Offers unlimited cryptocurrency withdrawals on the FTX exchange. To reach this level, you need to undergo an enhanced KYC: in addition to your passport or driver's license, you need to provide a document that confirms your place of residence, as well as a selfie.

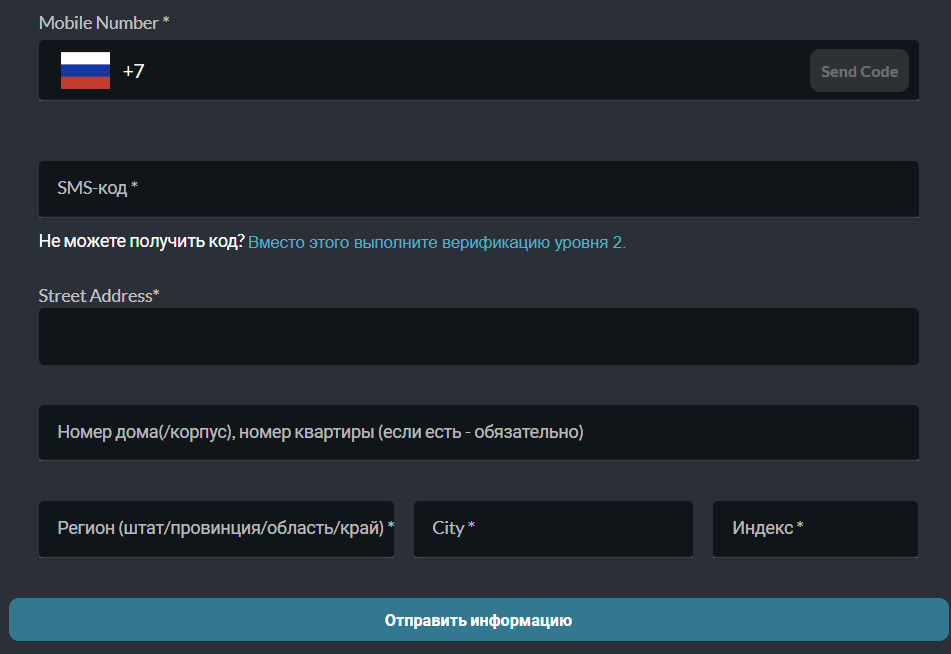

Immediately after registration, FTX prompts the user to complete the verification process, opening the following form:

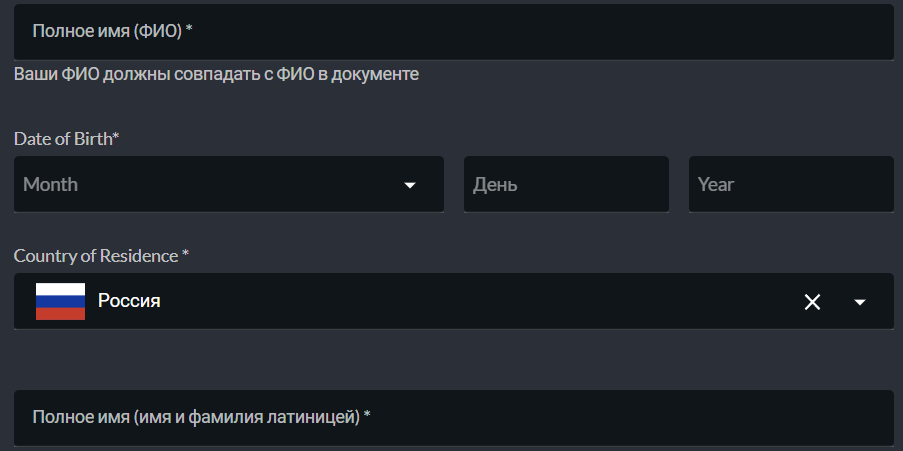

Choose the "Individual" verification type and provide:

- Surname, first name, and patronymic as in your passport;

- Date of birth: month / day / year;

- Country of citizenship;

- Latin transliteration of your name and surname. If you are unsure about the transliteration of your name, you can check it on your bank card;

- Mobile phone number (remember to send and enter the confirmation code);

- Street;

- House number;

- Region;

- City;

- Postal code.

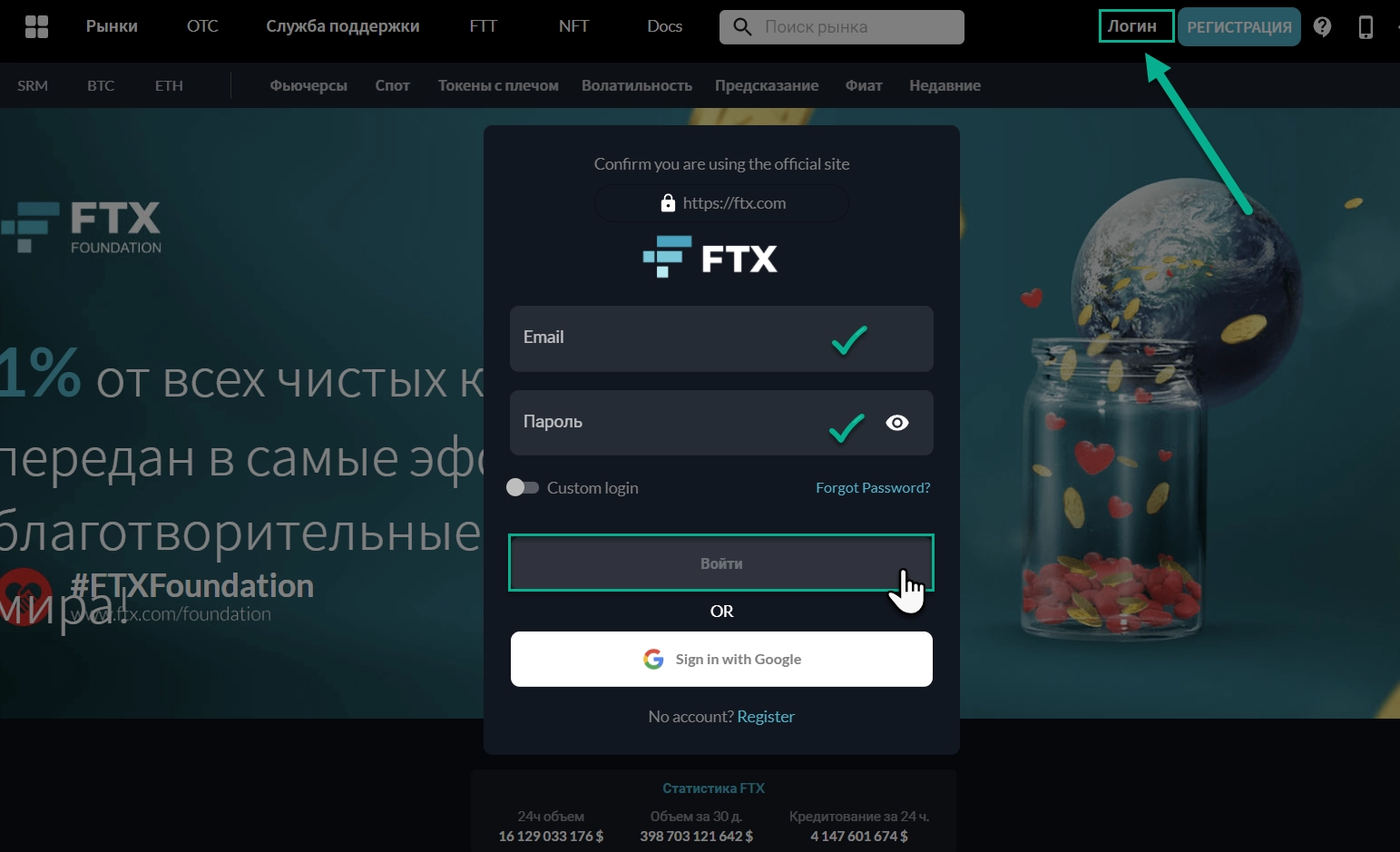

Authorization

To log in to your FTX account, go to the homepage and click on the "Login" button. Then:

- enter your email;

- enter the password you provided during registration;

- follow any security measures you have set up.

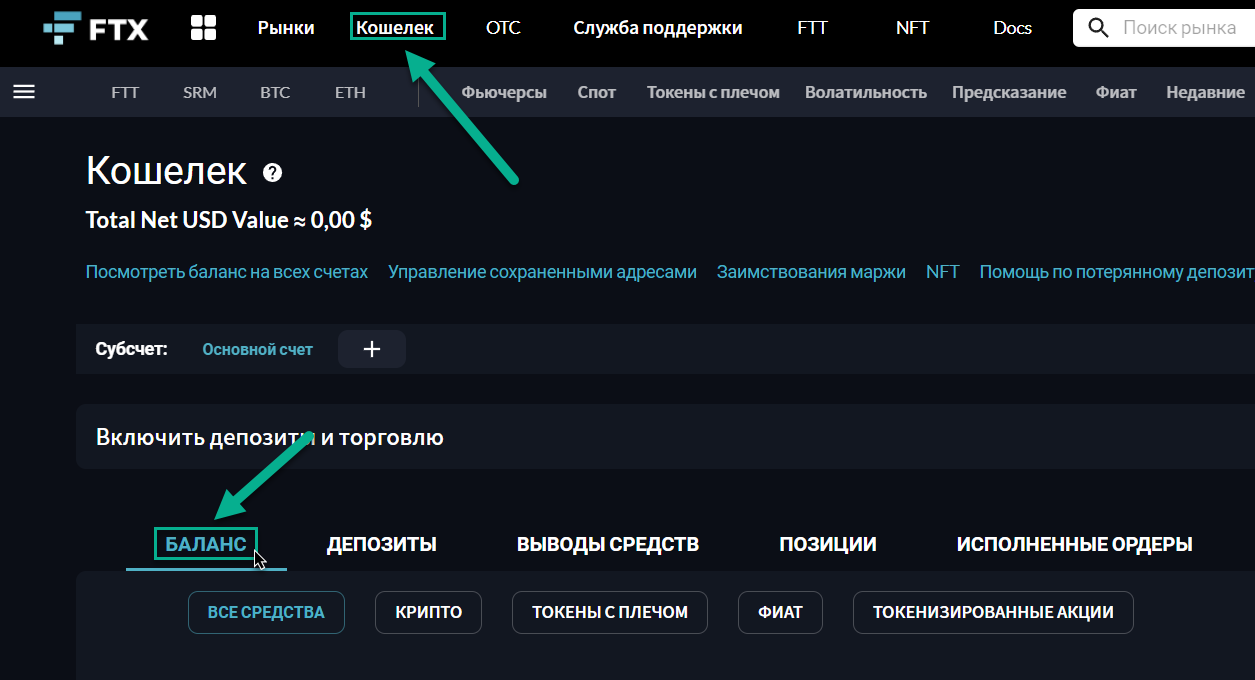

FTX Exchange: How to Deposit and Withdraw

FTX allows you to deposit and withdraw funds in both cryptocurrencies and fiat currencies (USD, EUR, RUB).

To deposit funds, go to the "Wallet" section, select the "Balances" tab, and choose the desired cryptocurrency. Then click on the "Deposit" button next to its ticker:

You will then be shown the wallet address to which you can send your deposit. The time it takes for funds to be credited depends on the number of confirmations in the blockchain network and its speed.

You can withdraw funds from FTX in the same way, by clicking on the "Withdraw" button. Specify the withdrawal amount and the wallet address.

Here's some information on how to withdraw from FTX and how to deposit to your FTX balance using a bank card or bank account. If you use your bank account for depositing and withdrawing funds in fiat, it's worth knowing that FTX does not charge any fees for fiat deposits, and there is a $75 fee for withdrawals of less than $10,000.

FTX Exchange Fees

The fees on FTX are charges for trading volume, which FTX collects for each of your trading operations, thus covering the costs of FTX's services. The platform has gained strong positions in the market overall by charging relatively low fees and quickly increasing liquidity. FTX charges 0.02% for makers (for market orders) and 0.07% for takers (for limit orders) with discounts based on trading volume, as shown in the following table.

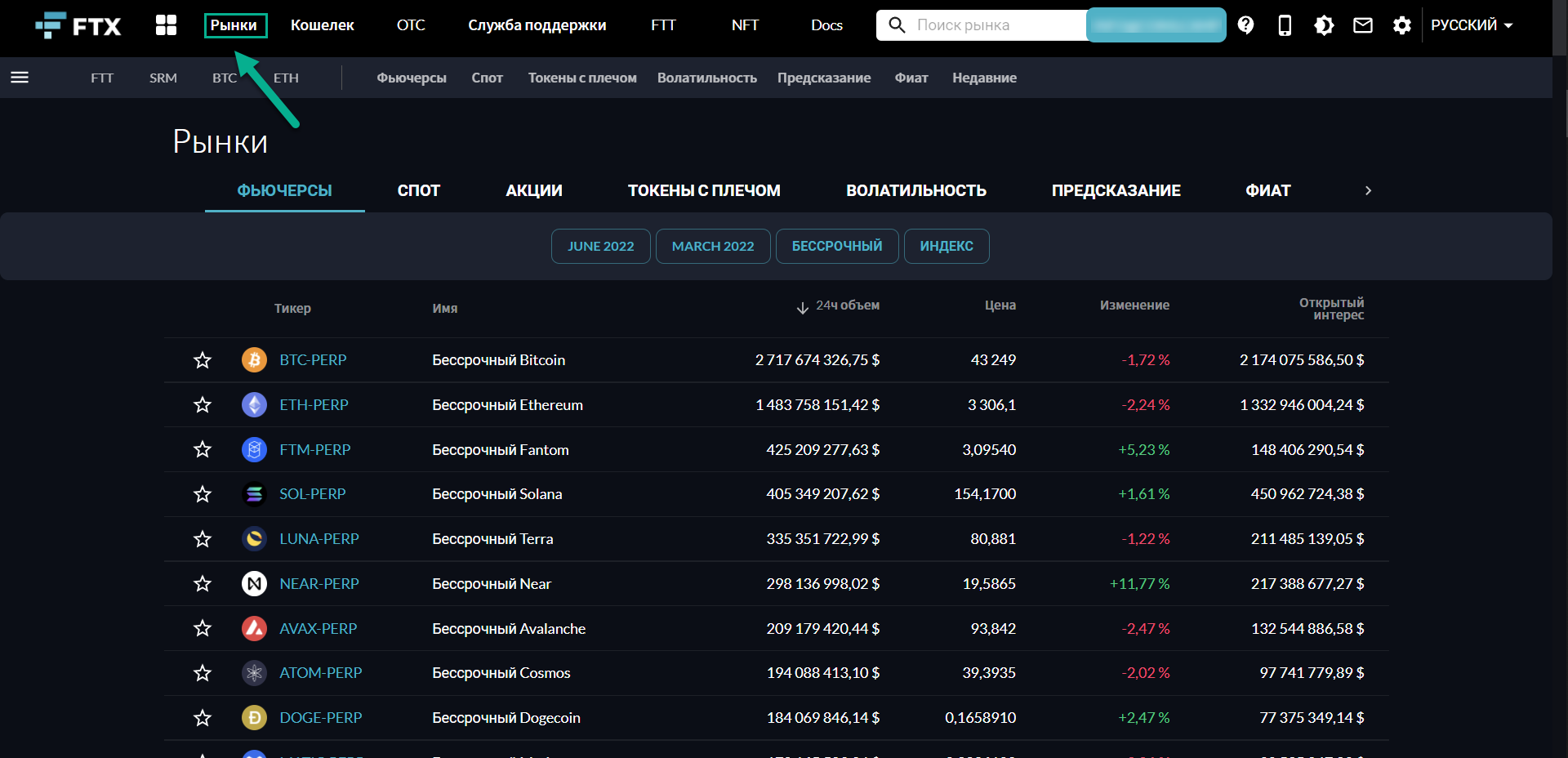

How to Trade on FTX?

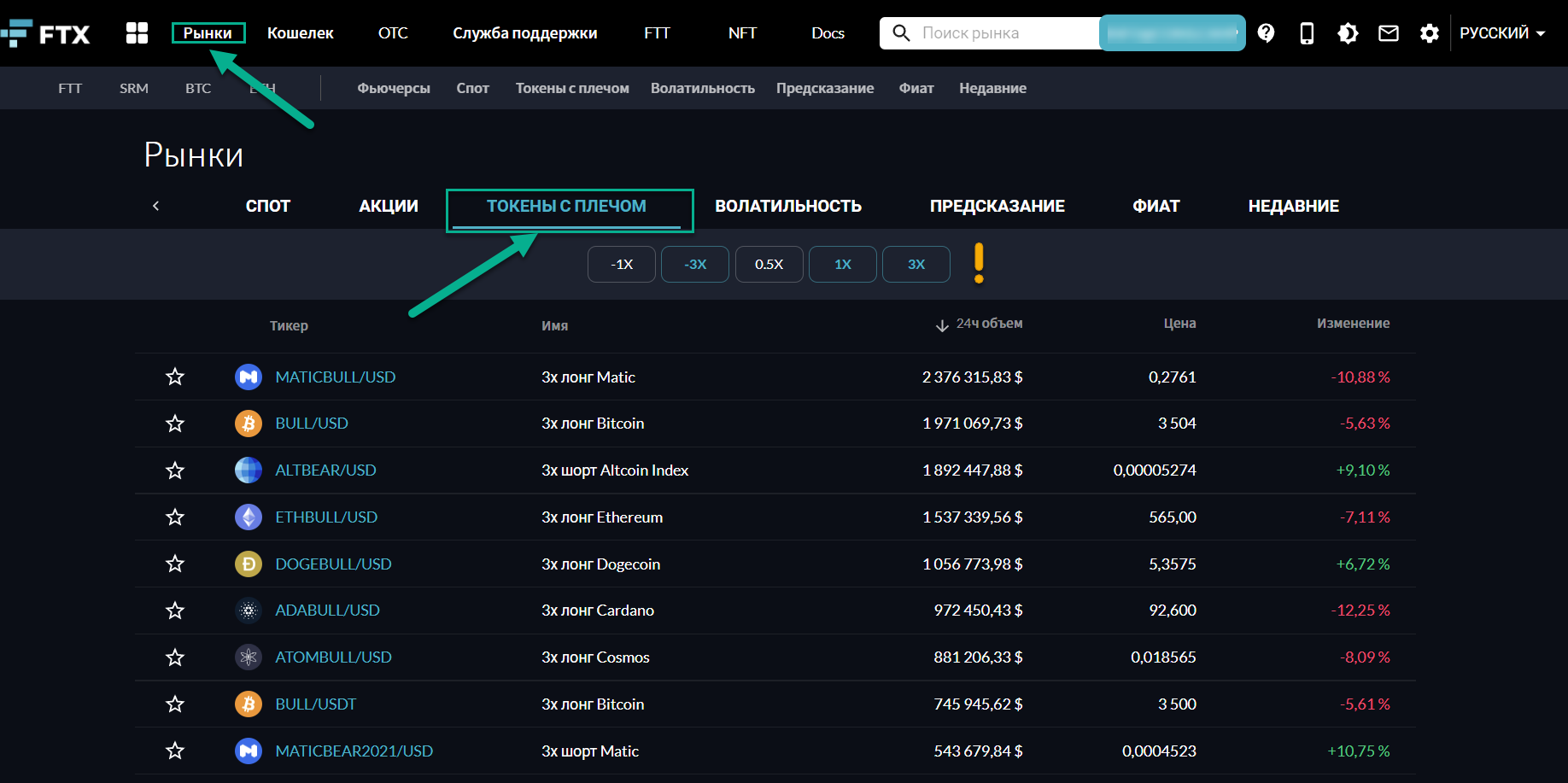

You can start trading by clicking on "Markets" in the top menu of the exchange:

As a result, you will first be taken to an overview of futures traded on the official FTX website 👉 FTX.com, sorted by volume in the last 24 hours.

Trading Futures on FTX

Futures and crypto derivatives have established themselves in the cryptocurrency market. The trading volume of derivatives now, in some cases, exceeds the trading volume of spot cryptocurrencies by two times.

With futures, you always trade based on the price change of a standardized asset. FTX has become one of the three most important futures exchanges in terms of trading volume, so there will be sufficient liquidity on this trading platform even for large amounts.

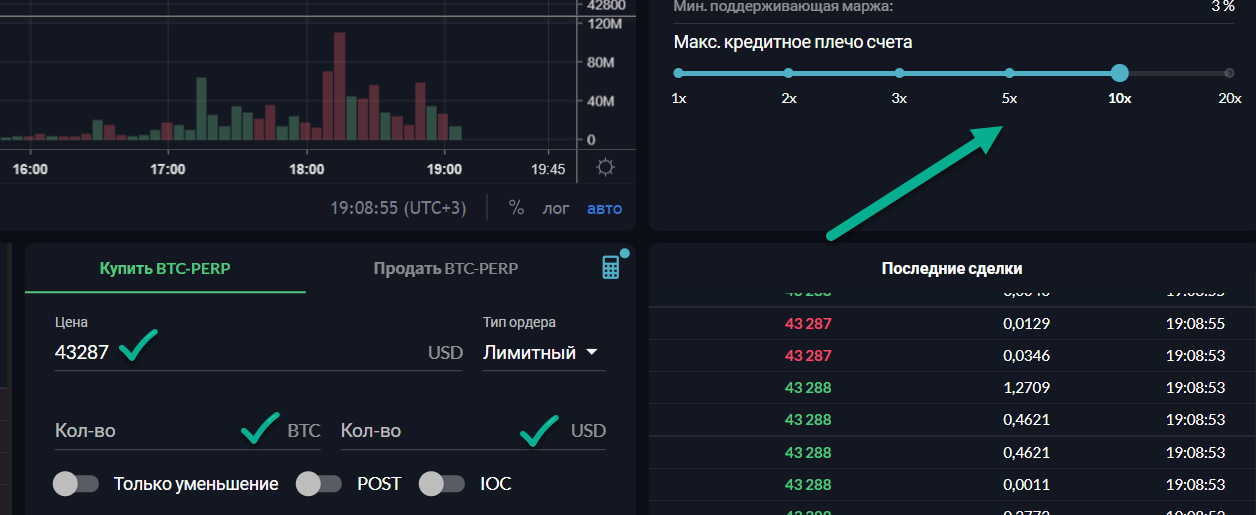

To trade futures, select a futures contract from the list provided, specify the leverage and position type (long/short), choose the order type, and enter the collateral amount:

Before trading, it is important to understand that there are two types of futures:

- Perpetual - do not have a fixed expiration date and financing rates are charged as a risk premium. On FTX, these contracts are denoted by "PERP," for example, for Bitcoin - BTC-PERP, and for Ethereum - ETH-PERP. Note that FTX collects financing rates on an hourly basis.

- Fixed-term - have a specified contract expiration date. Settlement occurs on a pre-determined date, and financing rates are not applied. On FTX, the expiration date in the American style is indicated by the abbreviation of the corresponding name, so "1225" means December 25th.

Regardless of whether you are in profit or loss, be aware of the risk of using additional leverage.

FTX allows for leverage of up to 20x. Note that for large positions, the maximum allowable leverage on FTX will be lower.

Spot Market on FTX

Spot trading involves the direct purchase/sale of cryptocurrencies rather than any synthetic derivative based on them. When trading on the spot market, you directly own the purchased cryptocurrencies.

The FTX platform provides the following types of trading orders:

- Limit stop-loss order;

- Market stop-loss order;

- Trailing stop order;

- Take-profit;

- Limit take-profit.

Leveraged Tokens on FTX

Another way to profit from the price dynamics of leading cryptocurrencies is to use leveraged tokens. FTX creates this financial instrument for Bitcoin, Ethereum, EOS, XRP, and others. You can find a full list on the official FTX.com website under the "Markets" section, then navigate to "Leveraged Token."

In simple terms, leveraged tokens are investments in a coin with an automatically embedded leverage. Leveraged tokens are technologically designed as ERC-20 tokens and are rebalanced daily. Leveraged tokens have sparked controversy in the crypto community due to their high level of risk. However, they also allow for incredibly easy multiple gains, provided that the trader's trading strategy is correct, they strictly adhere to the planned course, and do not succumb to emotional surges while having a good intuition for price changes.

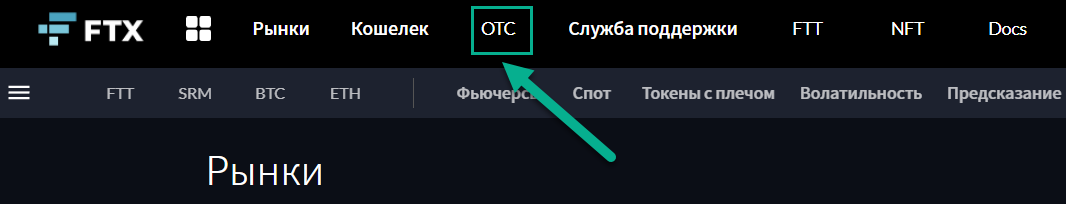

OTC Trading on FTX

OTC stands for "Over the Counter (Desk)," which refers to direct trading. Here, investors trade large sums of $1 million and above. This type of trading is used on the exchange because larger buy and sell orders can quickly lead to price drops and market crashes. To prevent these price fluctuations, FTX offers the OTC Desk.

To access this section, click on the "OTC" tab in the main menu:

Afterwards, you will be redirected to a separate web page and can start trading without any fees. To do this, you can use your regular FTX.com account, with which you created an additional wallet for trading on FTX OTC. You can also deposit fiat there.

The OTC Desk is particularly convenient for large trades as there are no fees. However, I recommend comparing prices with official and authoritative sources such as CoinMarketCap. Don't rely solely on OTC trading prices as they are not determined through the exchange but through direct trading.

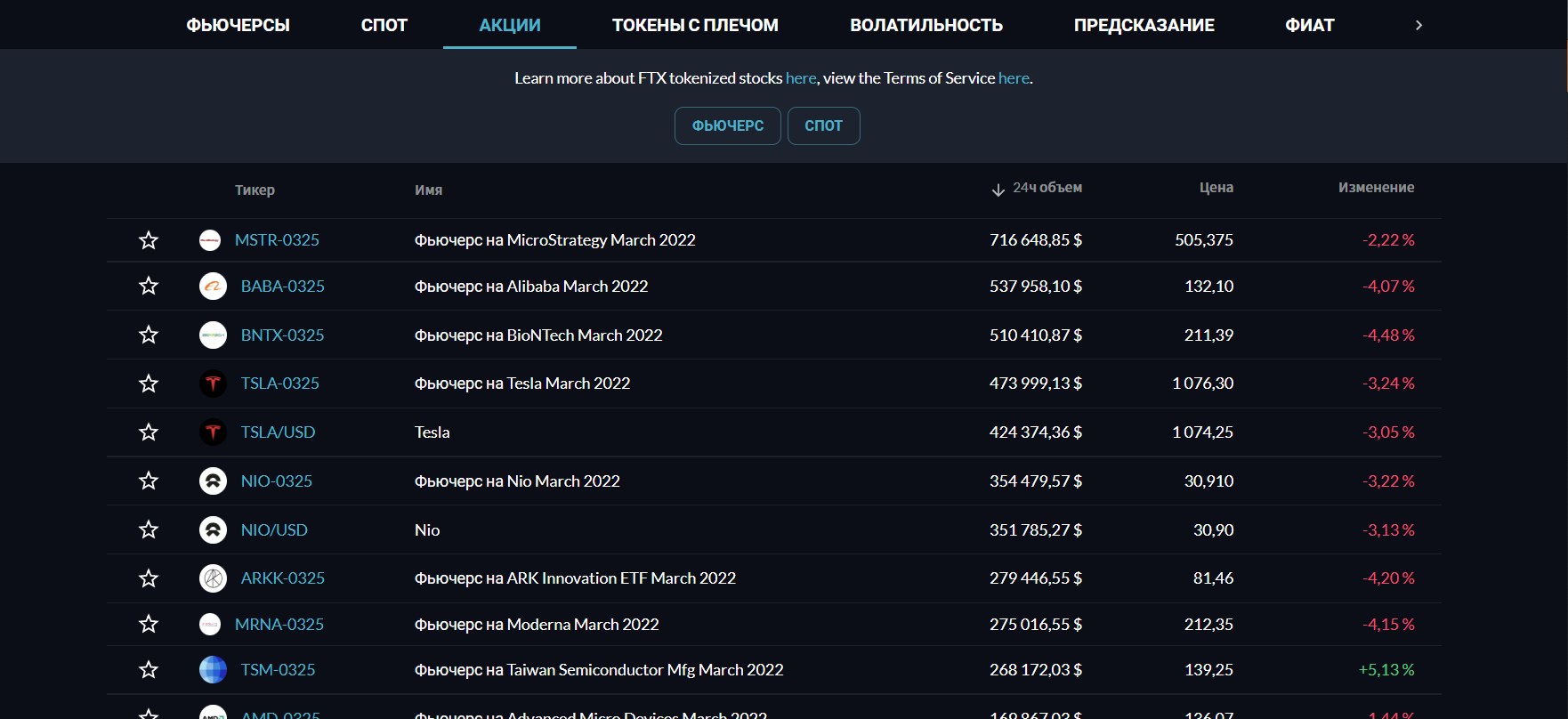

Trading Stocks on FTX

Stocks are also traded on FTX. Primarily, stocks of major U.S. technology companies such as Amazon, Tesla, Google, and Alibaba are traded. The provided stock product on FTX consists of tokens that are tied to the stock price. The unique feature is that these tokens can also be traded outside of regular trading hours and on weekends. Thus, you are no longer bound by the trading hours of traditional exchanges.

NFT Marketplace on FTX Exchange

FTX also has an NFT marketplace. NFT stands for Non-Fungible Tokens. It means that you can use it to own digital assets. Now, you can also trade them on FTX. Thus, anyone can list NFTs for sale on the marketplace or buy them there.

FTX charges a 5% fee on each NFT sale.

Security of Funds on FTX Exchange

The security of your funds is in your hands. Therefore, don't hesitate to follow these simple rules:

- Use complex passwords with a combination of symbols, numbers, and letters of different cases. Write down the password on multiple digital/paper storage devices and keep them in a secure place inaccessible to others.

- Create a separate email for the FTX exchange. Do not use this address anywhere else.

- Do not keep an active browser session when you are not at your computer. In other words, log out of your account after completing your tasks on the exchange.

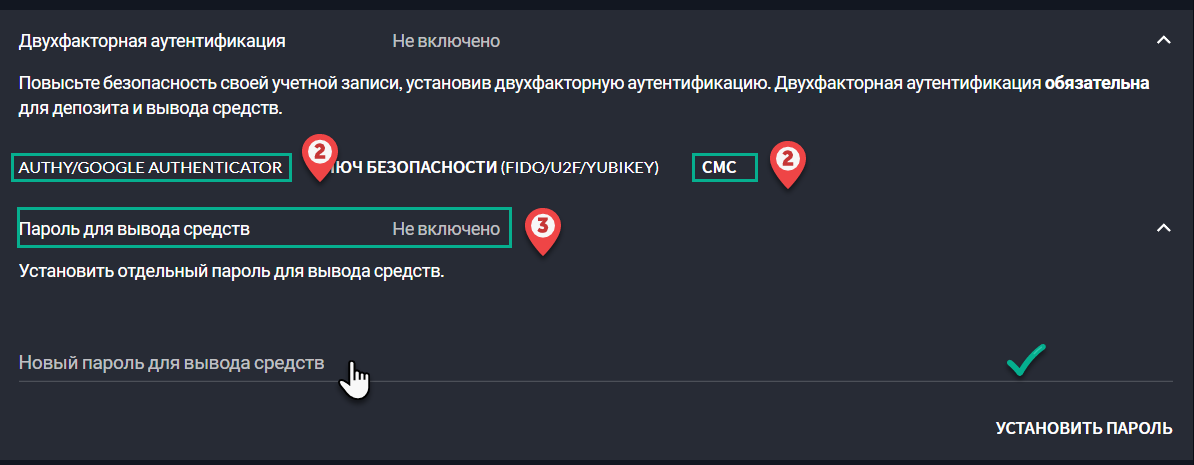

In addition, there are three reliable ways to enhance the security of your account:

- Enable Google Authenticator. For this, use a dedicated app from the Play Market. It only takes a couple of clicks.

- Enable SMS verification.

- Set up a special password for fund withdrawals.

As far as is known, FTX has not experienced any successful hacking attacks so far. However, no one can guarantee that this will always be the case. FTX claims to work continuously with digital and cybersecurity experts.

Deposits on FTX are not insured, so once again, use two-factor authentication and an additional withdrawal password. Additionally, try to store your funds in a hardware wallet.

Pros and Cons of FTX Exchange

Pros

- Support for 130+ different cryptocurrencies and 10 fiat currencies.

- Quick and easy exchange of coins and fiat currencies.

- Many markets suitable for experienced traders.

- Mobile applications for iOS and Android platforms.

- Staking available for several coins, including $FTT, which provides additional benefits.

- Intuitive official website FTX.com.

Cons

- High withdrawal fee in USD, amounting to $75.

- No chat support.

- Among Russian-speaking users, the reviews of the FTX cryptocurrency exchange are more superficial and do not provide a comprehensive assessment of the company's activities.

Conclusion

I wanted to conclude the FTX exchange review with a compact and informative summary. FTX is very user-friendly. Experienced developers have taken this into account and ensured that the design remains clean and that up-to-date data is in the foreground. FTX is particularly strong in futures trading due to its high liquidity.

In my opinion, FTX has become a leading platform for futures trading in a short period. The security concept of FTX is logical and has proven itself in practice. The fee policy is fair (FTX is probably the cheapest platform), and creating an account is very straightforward.