Huobi Crypto Exchange: Trading Review, Operation Manual and Reviews!

Exchange Token

HTLanguage

RussianVerification

Not requiredApps

IOS/Android/PCTrading Options

Spot | Margin | Futures | Leveraged TokensHuobi is a cryptocurrency exchange where you can directly buy and sell around 400 cryptocurrencies and also engage in trading with leverage (margin trading).

The exchange is suitable for both newcomers to the world of cryptocurrencies and finance, as well as experienced investors or traders who seek specific features and functionality from the exchange.

You will learn what sets Huobi apart from other crypto exchanges, how to register on the platform, and how to profit from working with cryptocurrencies.

Huobi Overview

A Brief History

Huobi was founded in 2013 by Leon Li, who had prior experience working as a programmer at the well-known company Oracle.

Initially, the exchange operated only in China. However, a year later, when Chinese authorities prohibited domestic cryptocurrency operations, the exchange obtained licenses to operate abroad, including in the United States, and Huobi Global was established. Its official website is 👉Huobi.com.

The exchange offers about 800 currency pairs for spot trading and nearly 200 trading instruments in the derivatives market.

Security and Guarantees

The exchange has a compensatory fund in case of force majeure events, ensuring the safety of clients' funds. If funds are lost, the exchange will compensate them from this fund in accordance with its rules.

Moreover, clients' funds are protected because nearly all of them (around 98%) are stored in "cold" wallets.

Strategic Products

Huobi Defi Labs

The exchange also founded the incubator Huobi Defi Labs, with an initial budget of $1 billion, which the company invests in promising crypto projects, particularly in the field of decentralized finance.

Huobi Prime List

For those interested in "x" opportunities, the Huobi Prime List service will be of interest.

Participation typically requires holding a certain amount of the exchange's tokens or achieving a specific trading volume. The conditions may vary, and it's better to check the specific prime list's terms.

Huobi Token

Like many other crypto exchanges, this platform has its own token - Huobi Token (HT). Huobi Token is built on the Ethereum blockchain.

Holders of this token enjoy the privilege of lower fees on the exchange.

Additionally, this token can be used by users to vote in the Huobi Autonomous Digital Asset Exchange (HADAX) ecosystem.

To maintain relative stability, Huobi allocates 20% of its profits to repurchasing HT from circulation. The maximum token supply is 500 million.

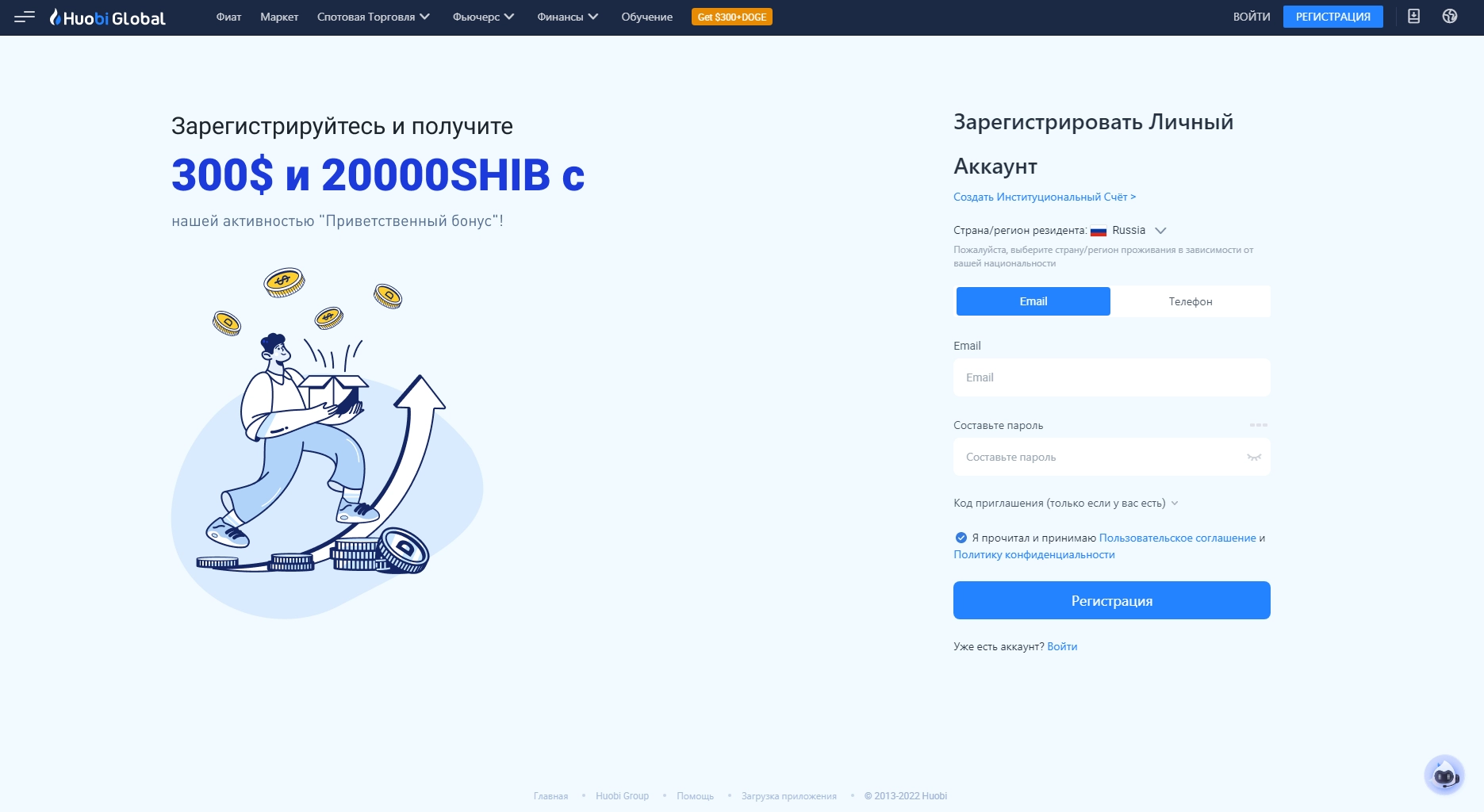

Registration on Huobi Exchange

Registration is straightforward. On the main page, click the "Registration" button located in the top right corner, highlighted with a bright blue background. Then, a page with the registration form will open.

Make sure your country is correctly specified, choose registration via email or phone number, create a password, and agree to the terms of the user agreement.

Depending on your chosen registration method, you will receive a code via email or phone, which you need to enter in the pop-up window to confirm registration.

After completing all procedures, you can use this trading platform.

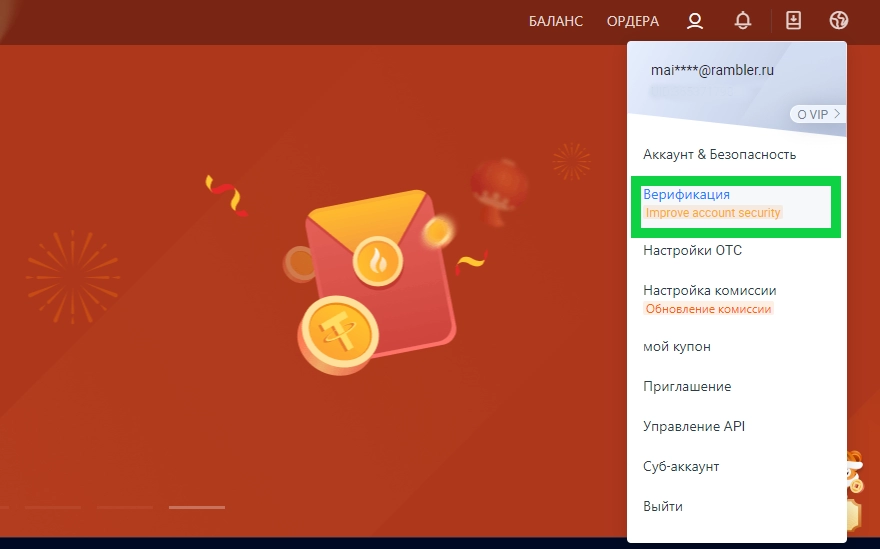

Verification on Huobi

Keep in mind that without verification, you will have a daily withdrawal limit of no more than 0.06 Bitcoin, and futures trading will be unavailable.

By completing verification, you can trade futures, and the withdrawal limit will increase to 100 Bitcoins per day.

To start the verification process, hover over the personal account button in the top right corner and select "Verification."

For verification, you need to upload scans or take photos of your passport, international passport, or driver's license.

For extended verification, which provides access, for example, to participate in Huobi Prime List, you'll need to take a photo of yourself holding the code provided by the system.

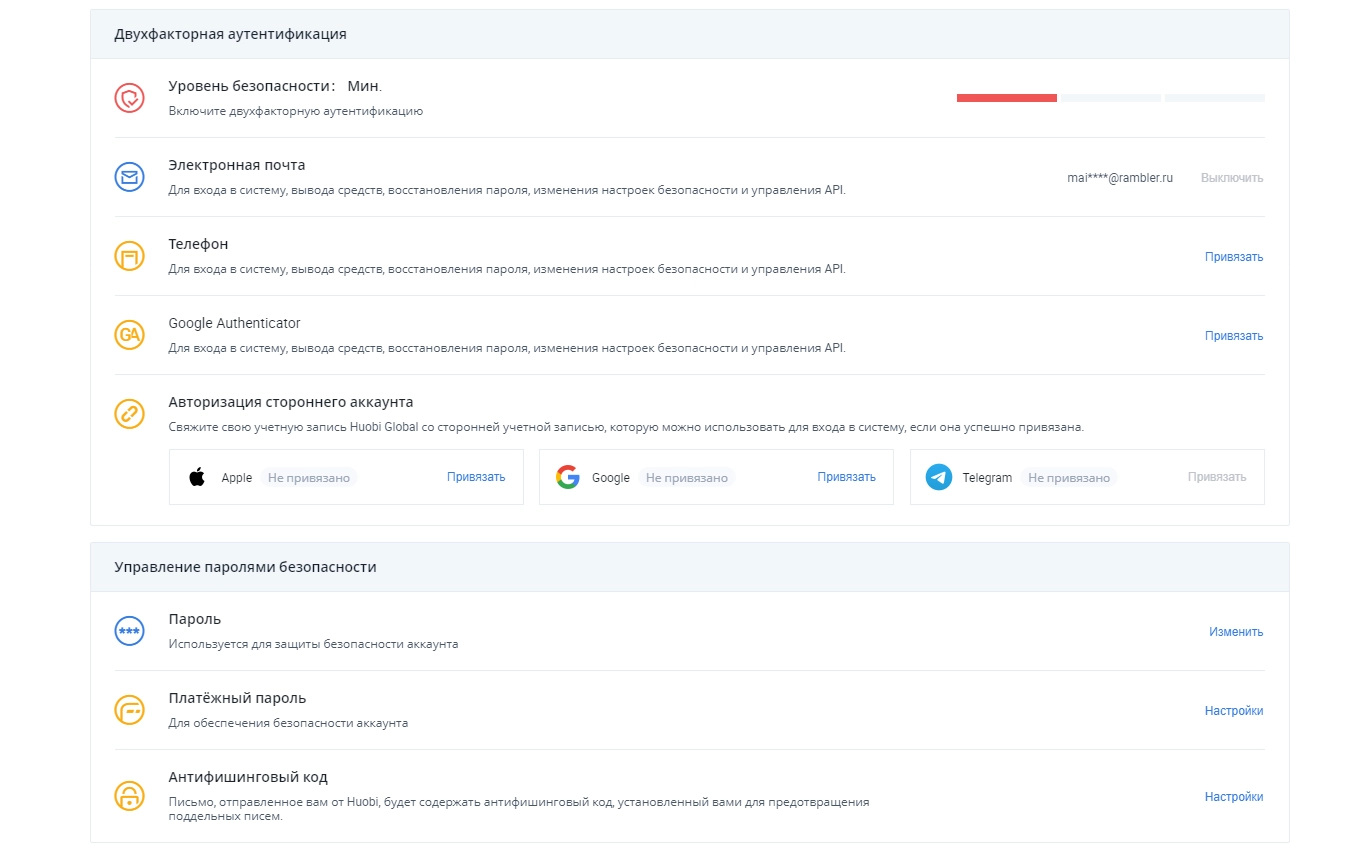

Security Settings

To enhance security, apart from verification, you can go to the "Account and Security" section in your personal account.

It's advisable to activate two-factor authentication by linking your phone, email, and enabling Google Authenticator.

With this enabled, you'll need to enter verification codes sent to your email, phone, and Google Authenticator app every time you log into your account and perform critical actions, such as fund withdrawals.

Additionally, you can enable a feature where every email from Huobi will contain an anti-phishing code that you create. This way, you can distinguish emails from the exchange, where the code is present, from emails sent by scammers, who may attempt to impersonate the exchange and its support service.

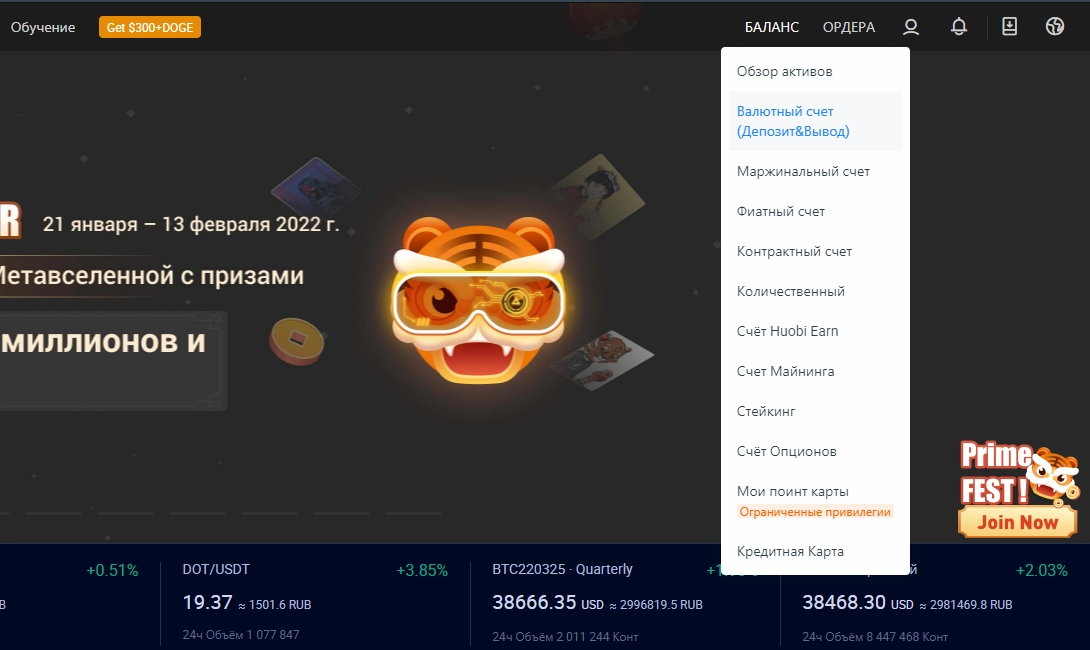

Huobi: How to Deposit and Withdraw Funds

You can deposit and withdraw both fiat and cryptocurrencies. To access your wallet, hover over the "Balance" button in the top right corner.

A menu will appear with options to deposit into various types of trading accounts, including spot trading, margin trading, options trading, mining, etc.

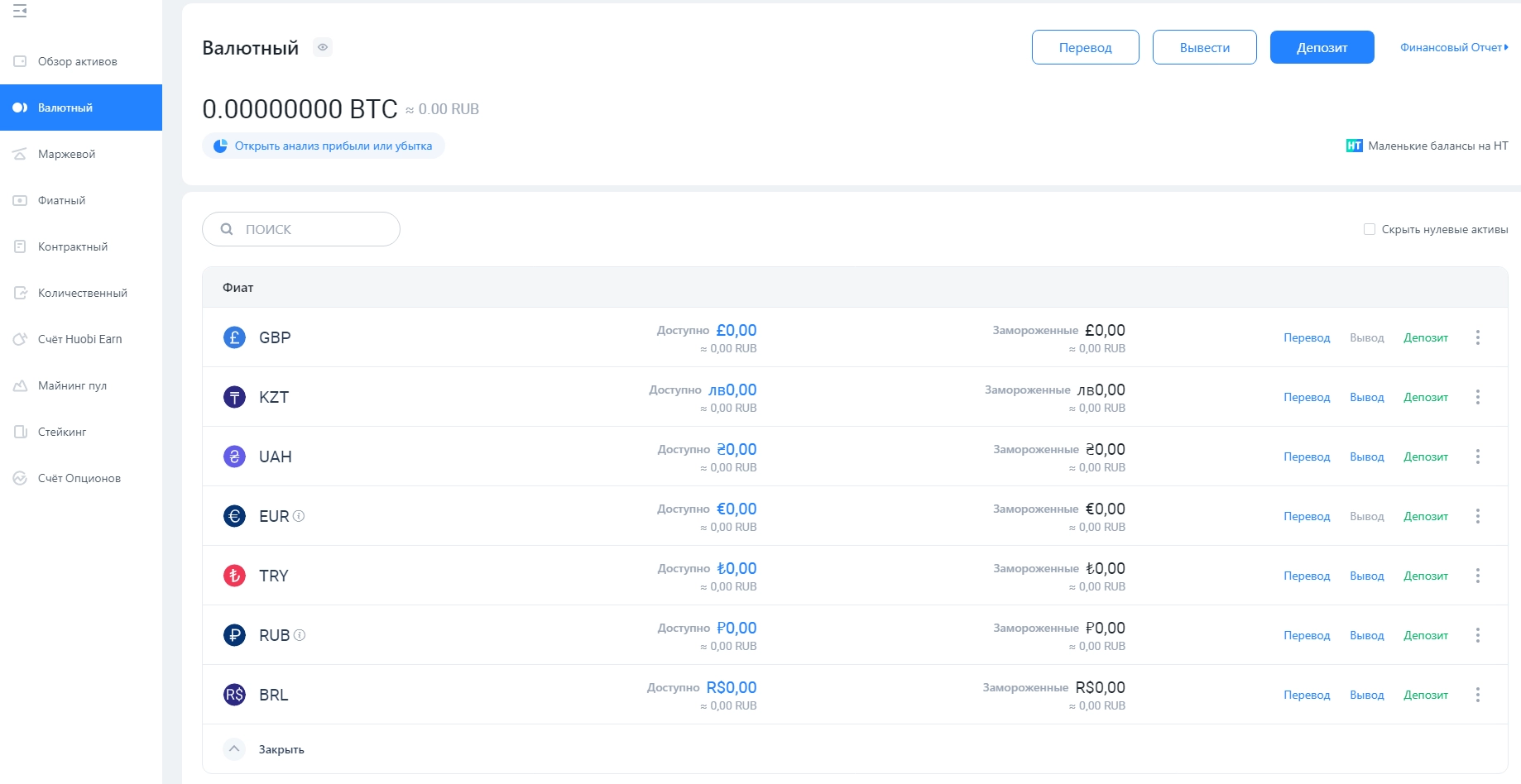

To access the section for depositing and withdrawing fiat and cryptocurrencies, click on "Fiat and Spot" (“Deposit & Withdrawal”).

As seen in the screenshot, you have a choice of many different currencies for deposit and withdrawal, including the Russian ruble.

Bitcoin is highlighted separately, and if you scroll down slightly, you'll find a list of all cryptocurrencies available for depositing, withdrawing, and trading.

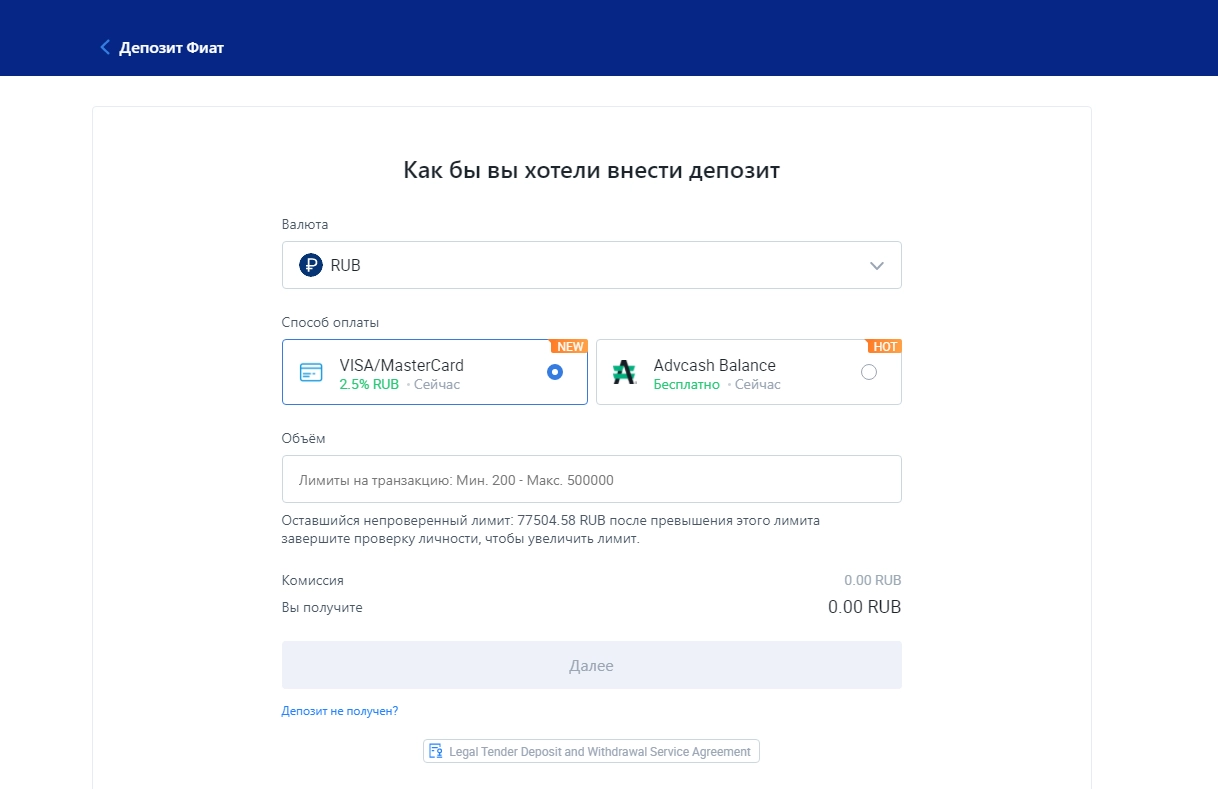

For fiat currency, you can use Visa or MasterCard, or other electronic payment systems for deposit and withdrawal.

Huobi does not charge any fees, but payment systems may have their fees, which are indicated in this deposit/withdrawal window.

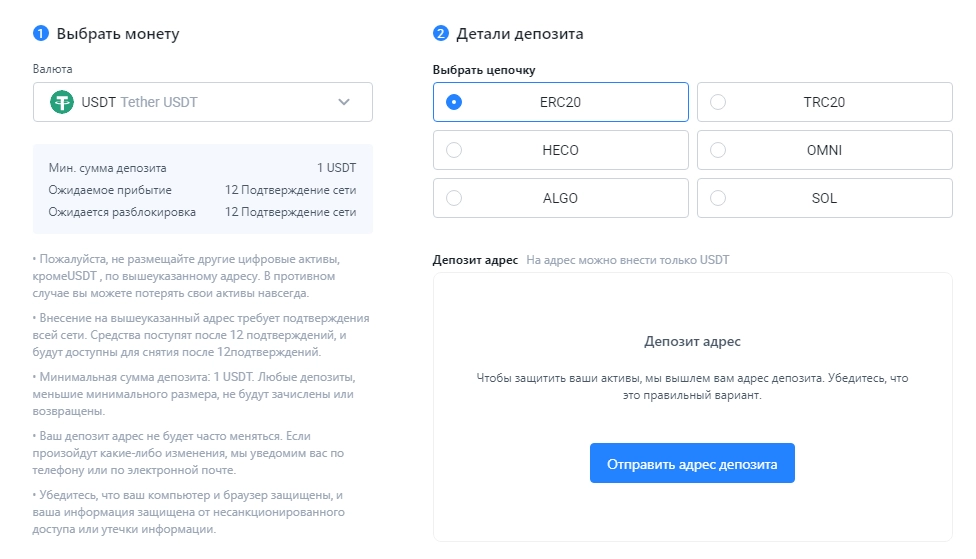

For cryptocurrencies, it's similar. If you want to deposit, click "Deposit," and for withdrawals, click "Withdraw." Then, select the cryptocurrency you want to deposit or withdraw and the network through which the transfer will be made. The network fee and the number of required confirmations for the transaction will be automatically indicated.

The "Transfer" button is used to move currency between different accounts on the exchange, for example, from your wallet account to your futures trading account, and so on.

How to Trade on Huobi

Spot Trading

Spot trading refers to the direct trading of cryptocurrencies, not derivatives like futures.

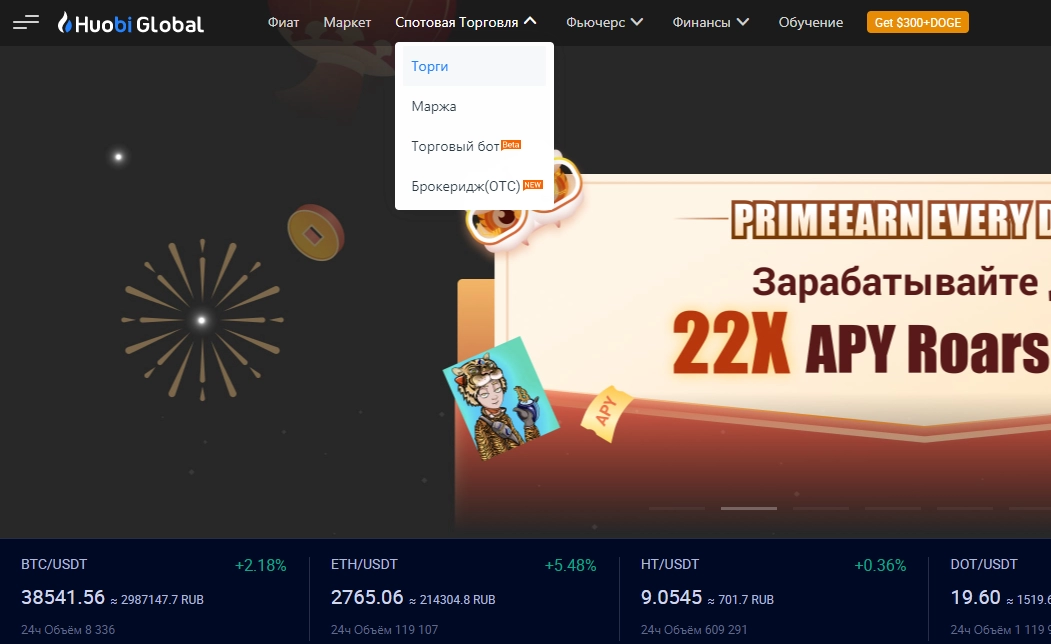

First, in the upper part of the screen, hover over "Spot Trading" and select "Trading" from the drop-down menu.

The trading terminal interface will load.

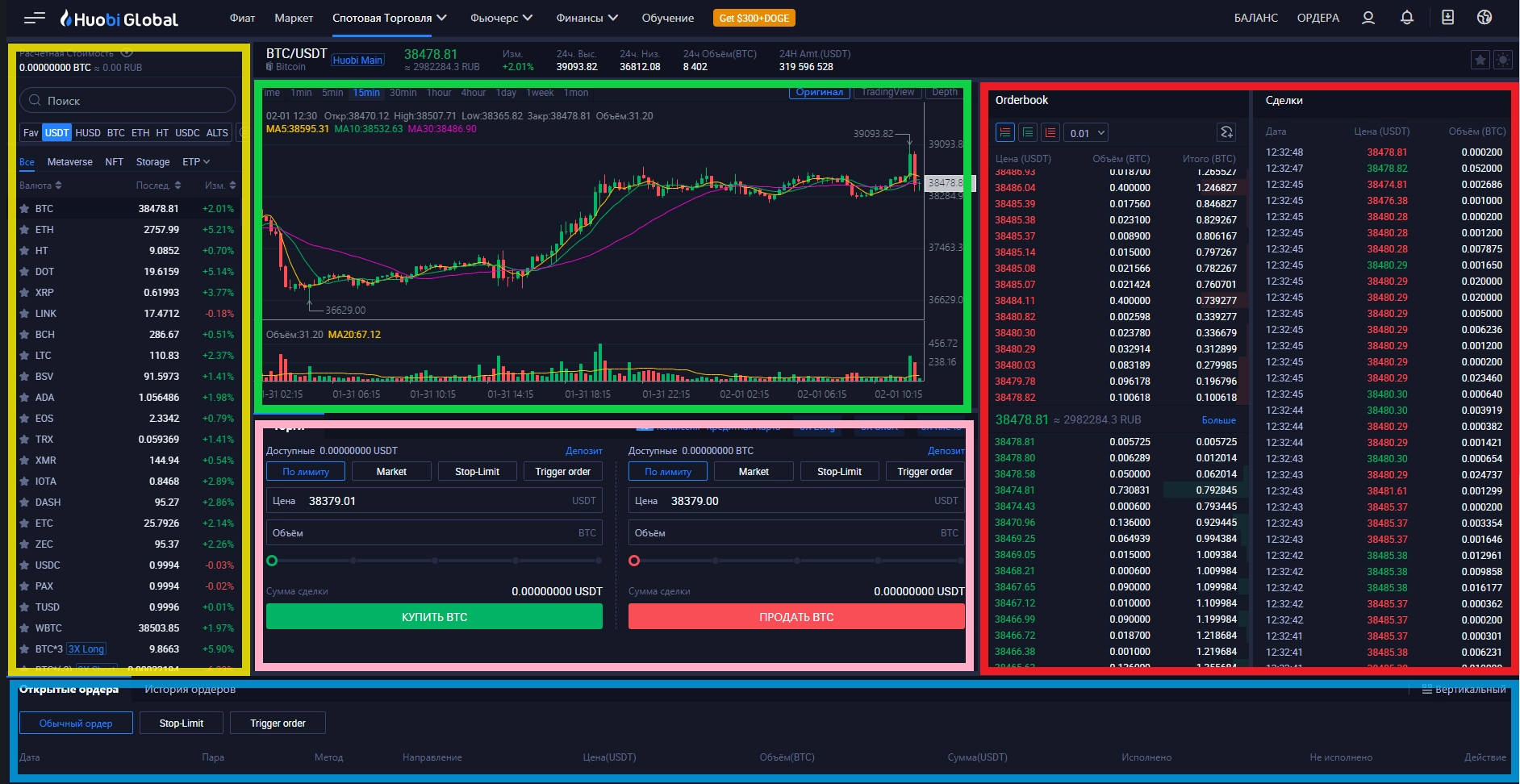

-

In the yellow rectangle, you can choose what you want to trade cryptocurrency against. For example, if you select ETH at the top, the menu will show currency pairs where Ether is the second currency. For example, BTC/ETH, KAVA/ETH, and so on. Slightly below, you can filter currencies related to metaverse, NFTs, or other crypto trends.

-

The green rectangle highlights the area with the chart of the selected crypto-currency pair. There's a chart from Huobi, a chart from TradingView, and you can view the market depth by volume. You can choose different timeframes for the chart at the top. Technical indicators, charting tools, and trading volumes can be applied to the chart.

-

The red rectangle on the right indicates the trading order book with volumes and the trade history tape, showing the trading volumes at the current prices.

-

In the pink rectangle is the "Trading" menu for placing trading orders.

You can choose the type of order you want to trade:

- Limit Order - You specify a quote at which you want to buy or sell, different from the current market price. When the current price reaches your quote, the order will be executed.

- Market Order - Buy or sell at the current market price.

- Stop-Limit Order - This order allows you to set a limit order when the price reaches a certain quote you desire. You enter the price for the limit order in the "Price" field, and in the "Stop" field, you enter the quote at which the limit order will be automatically placed.

- Trigger Order - Similar to the previous order but with one difference. When the market price reaches the quote you specify in the "Stop" field, you can now enter the trade not only with a limit order but also at the current market price with the price specified in the "Price" field.

-

Next, in the "Volume" field, choose how much you want to buy or sell, and then click "Buy" or "Sell." You'll either buy or sell at the market price if you chose a "Market Order," or one of the pending orders from the list above will be placed.

-

In the bottom part marked in blue, the list of active orders or Order History with past trades and canceled limit orders (if you canceled them before they were executed) is displayed.

Margin Trading and Futures Trading

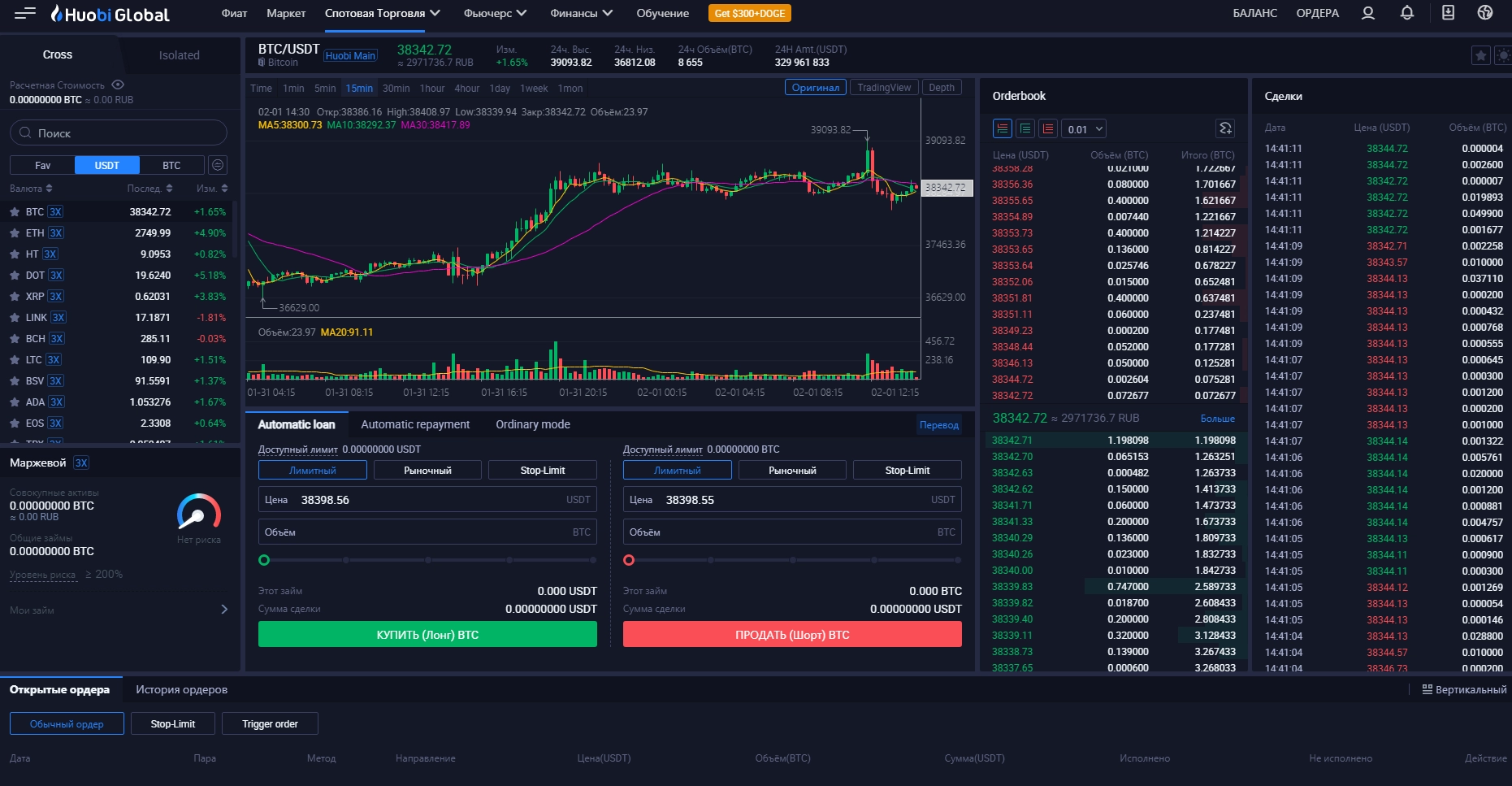

Margin Trading

Huobi offers margin trading, which means trading with borrowed funds.

If you have a certain cryptocurrency but want to buy or sell more than you have, you can use the exchange's borrowed funds.

Your cryptocurrency goes into collateral for the duration of the margin trade, and the exchange adds its cryptocurrency.

However, keep in mind that each price movement against your trade (in our example, if the price starts to rise) will cost you three times more. Once your Bitcoin is depleted, the exchange will forcibly close the trade to avoid losing the 2 Bitcoins it lent you.

To access margin trading, select "Spot Trading" -> "Margin" in the top menu.

The interface looks similar to the standard Trading section, but opposite the currency pairs, the leverage size that the exchange can provide is indicated.

Futures Trading

Futures trading includes leverage that can be chosen by the user. But it is not necessary to have precisely the cryptocurrency that the futures contract is based on. It is enough to have USDT or Bitcoin for which the futures contract is bought or sold.

You can access the futures section through the top menu by selecting "Futures."

To be able to trade futures, you need to go to the "Balance" section and transfer funds from your Fiat account to your Contract account.

Huobi Fees

The fee policy may change, so it is best to check this information yourself through the "Balance" menu by selecting the commission settings.

Huobi Review

Huobi is rightfully among the largest cryptocurrency exchanges for understandable reasons. It offers users a wide range of trading possibilities, including spot trading, margin trading, futures trading, options trading, staking, and much more.

One of its nice features is Prime List, where new tokens are listed and can give significant returns to investors. This has attracted a large number of clients to the exchange.

As for drawbacks, some may find that without verification, the withdrawal limits are modest, customer support may not respond fast enough, or not all translations are perfect in Russian.